Simplify, Expedite and Expand the adoption of

Real-Time Payments Globally

Global Payment Platform (GP2)

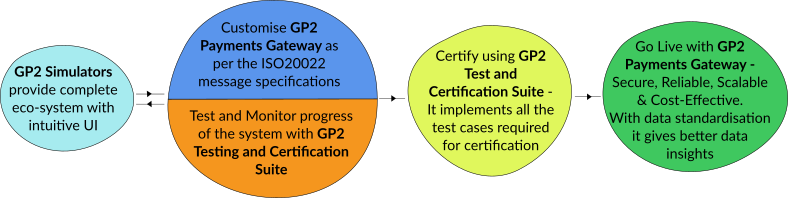

Real-Time Payment platform for Testing, Certification and Gateway to connect to any ISO20022 based clearing and settlement system

Planning to Join Real-Time Payment Revolution ?

With the number of RTP systems increasing fourfold since 2014, the reasons, investment and drive to transition to instant payment is clearly there. The real time payments environment is constantly marching onwards and upwards.

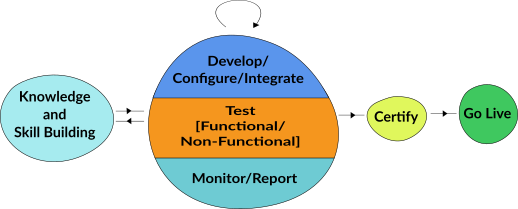

Everyone wants to join the revolution but it’s not as simple as signing up and paying some dues. To join any Real Time Payments network, banks and PSPs need to go through a full adoption lifecycle.

The good news is that Bhuma’s GP2 product line supports every step of that lifecycle. Bhuma’s GP2 is right there at the top, bringing you scalable solutions which enable banks/ PSPs to easily join any ISO 20022 based Real Time Payments network across globe.