GP2 – Platform for growing the Real-Time Payments Eco-System

GP2 consists of following products:

- GP2 Testing and Certification platform

This platform helps to speed up your readiness to join any real-time payments network by testing and certifying your solution with the automated functional, non-functional and certification test cases. The execution progress of the test cases can be monitored and reported. In addition, it can help to build knowledge and skill within the team using it’s intuitive UI.

- Payment Gateway for Bank and PSPs

A fully secure, reliable, reconcilable and scalable system which implements any ISO20022 message to provide the required functionality. It can be integrated with any ISO20022 based clearing and settlement system through standard API or IBM MQ. This can be offered on-premises or via fully managed cloud service to Banks/PSPs.

- GP2 ISO20022 Transformer

Transforms ISO8583 or any legacy message to and from ISO20022 message. Provides MAC/XML signature generation/validation, structural validations, business validations and reference data/master data based data enrichment. It also offers message routing capability and connectivity using TCP/IP sockets, REST API and queue.

GP2 implements any ISO20022 message

GP2 Key Building Blocks

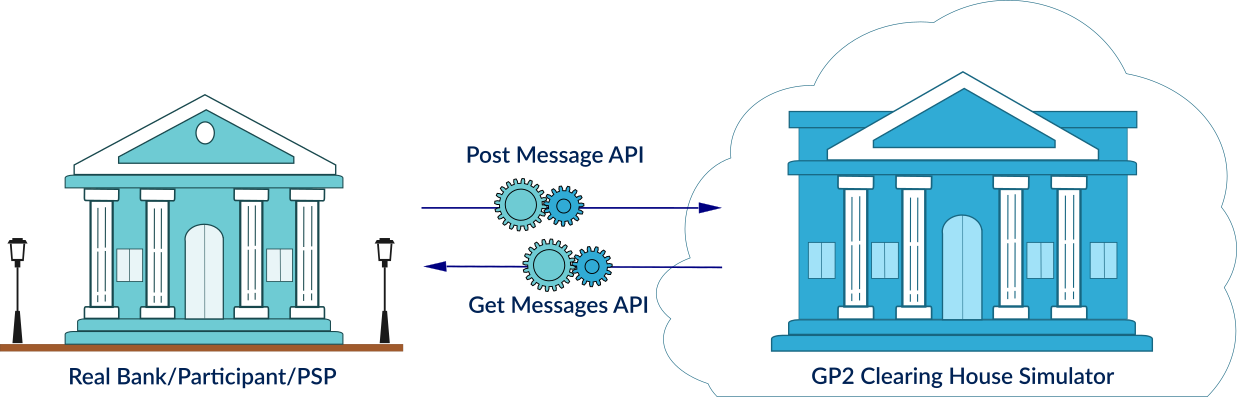

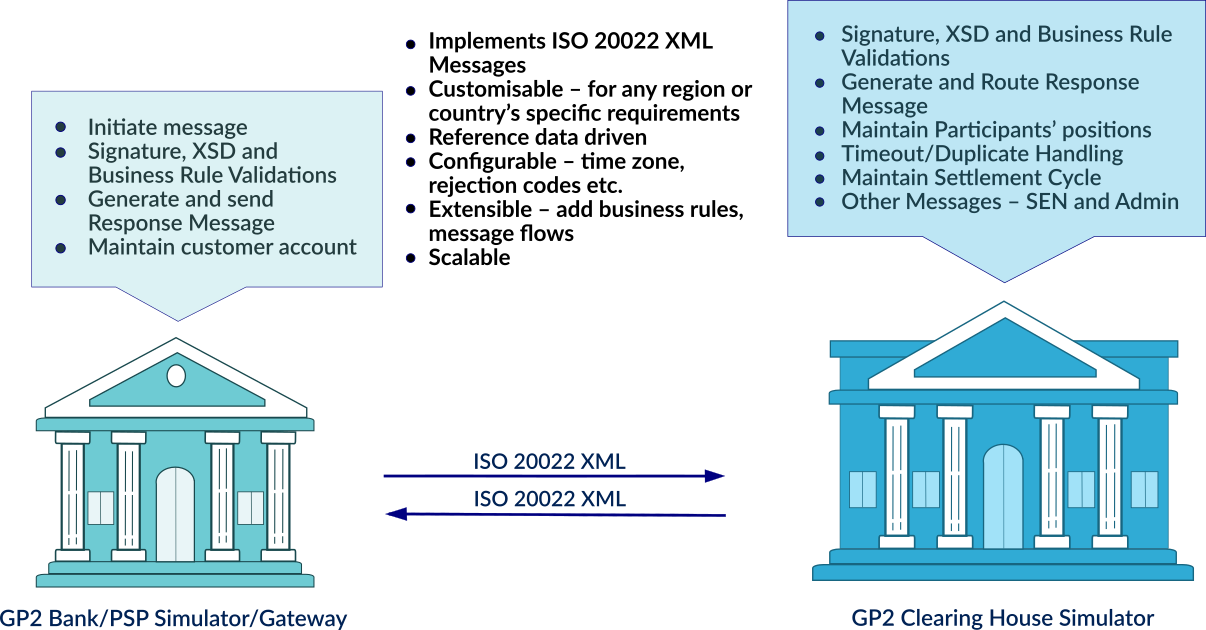

Bank/PSP and Clearing House Simulator

Key Benefits

Education and training for business use cases with the help of interactive UI

Testing of all ISO20022 payment message flows (including individual and co-related messages, validating end-to-end business scenarios).

Automated and UI-based tests execution, reports and certification capability.

Empowering agile or iterative development for building real-time payments capability.

Cost-efficiency – Bhuma’s cloud-based service is available 24/7 on a competitively priced subscription model (with minimal upfront cost).

Reducing adoption time – thereby accelerating the scaling up of a global real-time payments eco-system.

Encouraging collaboration – by reducing the knowledge gaps between teams and imbibing a common understanding.

Driving innovation/agility – via the ability to add new business flows and rules.

Clearing House Simulator Workflow and Settlement Features

General Workflow Features

- XSD, Signature and Business Rules Validation

- Processing of all ISO20022 payment and admin messages

- Repeat Message Handling

- Duplicate Message Handling

- Timeout Message Handling

- UTF8 Character Set Support

- Generate SEN

- Support for multi connections.

Settlement Features

- Supports both Pre-funded and Deferred Net Settlement Models

- Create/Edit Settlement Calendar

- Cutover functionality based on Settlement Calendar

- Maintain Debtor/Creditor Net Position

- Credit/Debit Settlement Account

- Generate SEN

Workflow Configurability and Extensibility Features

- Time zone, Currency and Business Rules Rejection reason code Configurability.

- Business Rules Execution Sequence Configurability

- Add/Delete a business rule

- Add New Business Flows

Bank/PSP Workflow Features

General Workflow Features

- XSD, Signature and Business Rules Validation

- Processing of all ISO20022 payment and admin messages

- Repeat Message Handling

- Duplicate Message Handling

- Timeout Message Handling

- UTF8 Character Set Support

Workflow Configurability and Extensibility Features

- Time zone, Currency and Business Rules Rejection reason code Configurability.

- Business Rules Execution Sequence Configurability

- Add/Delete a business rule

- Add New Business Flows

UI Features

Reference Data Setup

- Onboard Bank/Participant

- Maintain Contact

- Maintain Test Template

- Maintain Certification Criteria

Criteria Execution and view Transaction

- Execute Certification Criteria

- View Certification Criteria Execution Report

- View Payment Transactions

- View Payment Related Transactions

- View SEN Messages

- View Admin Messages

Settlement

- View Settlement Summary

- Credit/Debit Settlement Account

- Create Settlement Cycle Snapshot

- View Settlement Cycle Snapshot

API

Service Offerings

Subscription service

- For functional and nonfunctional testing

- For Payment Gateway

- Fee will be based on

- No of users

- No of transactions per day

- Support – Working hours 09:00 to 18:00 (24/7 available on request)

- Training – Online Training included (Onsite training available on request)

Onsite Consultancy services

- Product/Requirement Management

- Architecture and Design

- Testing Services

On premise services

- On premise/dedicated cloud service for Volume and Performance testing

- Fee will be based on

- On-premise vs Dedicated Cloud cluster

- Number of transactions/Second